About this episode

In 2013, Kate Field started The Kombucha Shop offering home-brew kits that people can use to make kombucha.

By 2018, the kombucha craze was in full swing, and Field was invited to pitch her business on Shark Tank. Field asked for $350,000 in return for 10% of her company which was generating around $1.2 million per year selling kombucha kits. Field got an offer for $200,000 in cash and another $150,000 line of credit in return for 10% of her company from Barbara Corcoran and Sara Blakely, the Spanx founder who was a guest Shark that day.

Despite her success on television, a series of surprising events led Field to walk away from the Shark’s offer and sell The Kombucha Shop the following year. This episode is a raw account of the highs and lows of the entrepreneurial journey. Listen and you’ll learn everything you need to know before you go on Shark Tank or approach just about any investor. You’ll also discover:

- How Field financed The Kombucha Shop with just $800 of startup funding.

- Why Field left Mark Cuban speechless during her pitch.

- Why a one-time spike in sales could undermine your negotiating position when you want to sell.

- The biggest mistake Field made in her first attempt to sell The Kombucha Shop.

- Why Field equates selling a business to the grieving process of losing a loved one.

This episode was brought to you by Work Better Now. Work Better Now has helped match hundreds of businesses with talented virtual assistants. Reach more clients, expand your influence and be more productive – not busy. Work Better Now is currently offering Built to Sell listeners and readers $150 off per month for three months, just by mentioning Built to Sell.

Show Notes & Links

From The Kombucha Shop > Brew Q&A > Cultures:

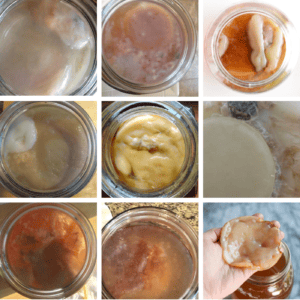

“Healthy Cultures

A healthy kombucha SCOBY will have brown, stringy or blob-like debris attached to it (the yeast). It can be bumpy or smooth on top, and have clear dots or bubbles. When you drop your new culture into the brew jar along with the starter liquid, your culture can sink to the bottom, float in the middle, or float on top—all locations are just fine and will ferment your kombucha just the same. Here are some photos of beautifully weird looking (but healthy) SCOBYs in all their glory.”

About Our Guest

Kate Field

Kate is the Founder and former CEO of The Kombucha Shop, an e-commerce company that provides everything you need to brew incredible kombucha at home. She bootstrapped the company solo in 2013 with less than $1000 and built it to become the largest kombucha homebrew supplier in the world. In 2018, Kate took The Kombucha Shop into the Shark Tank, where she struck a deal with investors Barbara Corcoran and Sara Blakely. Her pitch was named the #2 moment of the season by Inc. Magazine. In June 2020, Kate made the decision to sell The Kombucha Shop to embark on new adventures and opportunities.

Today, Kate finds joy in exploring new business ventures, investment opportunities and advising fellow entrepreneurs on their journey. She loves all things design-related, real estate, trail running, and eating good food in ATX.

Connect with Kate: