About this episode

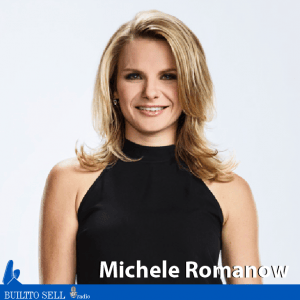

SnapSaves was created by Buytopia, which has a deal-of-the-day business model similar to Groupon. Started by Michele Romanow and her partners in Buytopia, the idea was to let shoppers snap a picture of their grocery receipt using the app.

Romanow started pouring more than $100,000 per month into SnapSaves, and within six months had a product she could take to market. The company was a quick hit with consumers and advertisers, and within a year of launch, Romanow was entertaining venture capital investment offers which implied a whopping $25 million valuation for the young company.

That’s when Groupon called and said they wanted to buy SnapSaves outright.

Romanow, who now stars as an investor on Dragon’s Den (the Canadian version of the hit show Shark Tank), negotiated hard with Groupon and got them to double their offer from their first term sheet, which is when Romanow decided to sell.

In this episode, you’ll learn:

- What M&A bankers call a “tech and team” deal.

- The three currencies public companies use to buy businesses.

- What Romanow looks for when investing in a company on Dragon’s Den.

- How to use customer cohorts to track and boost the value of your company.

- The difference between a term sheet and an LOI.

What’s Your ‘Unfair Right to Win’?

Romanow has evolved from an entrepreneur into an investor and now looks to bet on companies with what she calls “an unfair right to win”, which is what we call your Monopoly Control. We’ll help you figure out your Monopoly Control in Module 6 of The Value Builder System™—complete Module 1 for free by completing the Value Builder questionnaire now.

Check out our article on How You Treat New Customers Impacts Your Company’s Value.

About Our Guest

Dragon”, CBC Dragons’ Den | Co-Founder, Clearbanc Michele Romanow is an engineer and a serial entrepreneur who started three companies before her 28th birthday. The newest (and youngest ever) entrepreneur to join CBC’s hit show Dragons’ Den, Michele is the co-founder of e-commerce platforms Buytopia.ca and SnapSaves (acquired by Groupon), which have saved millions of users hundreds of millions of dollars. Ranked in WXN’s “100 Most Powerful in Canada” and listed as the only Canadian on Forbes’ “Millennial on a Mission” list. Her current venture Clearbanc is offering financial services for freelancers and entrepreneurs.