This week we’re using 23andMe’s $400 million acquisition of Lemonaid Health as a springboard to cover three ways to protect your downside in an acquisition, including how to:

- Assess the liquidity of your acquirer

- Negotiate your lock-up period

- Use “put” options to cover your downside

Paul Johnson co-founded Lemonaid Health in 2013 with the intent of offering doctor visits over the phone. As he shared with John in this week’s Built to Sell Radio episode, initially, the business had a slow start. However, when the pandemic struck, virtual doctor consultations became a necessity, leading to the company’s rapid growth.

Seeing the potential of telemedicine, investors backed Johnson, enabling him to raise a total of $60 million dollars through multiple funding rounds.

In 2021, the telehealth company caught the eye of Anne Wojcicki, the CEO of the genetics testing company 23andMe. Wojcicki was interested in the idea of providing personalized virtual healthcare based on someone’s genetic profile, and was actively looking for a telehealth company to partner with. On November 1, 2021, it was announced that 23andMe had acquired Lemonaid for $400 million — with the payment being comprised of 25% cash and 75% in 23andMe stock.

A Fly in the Ointment

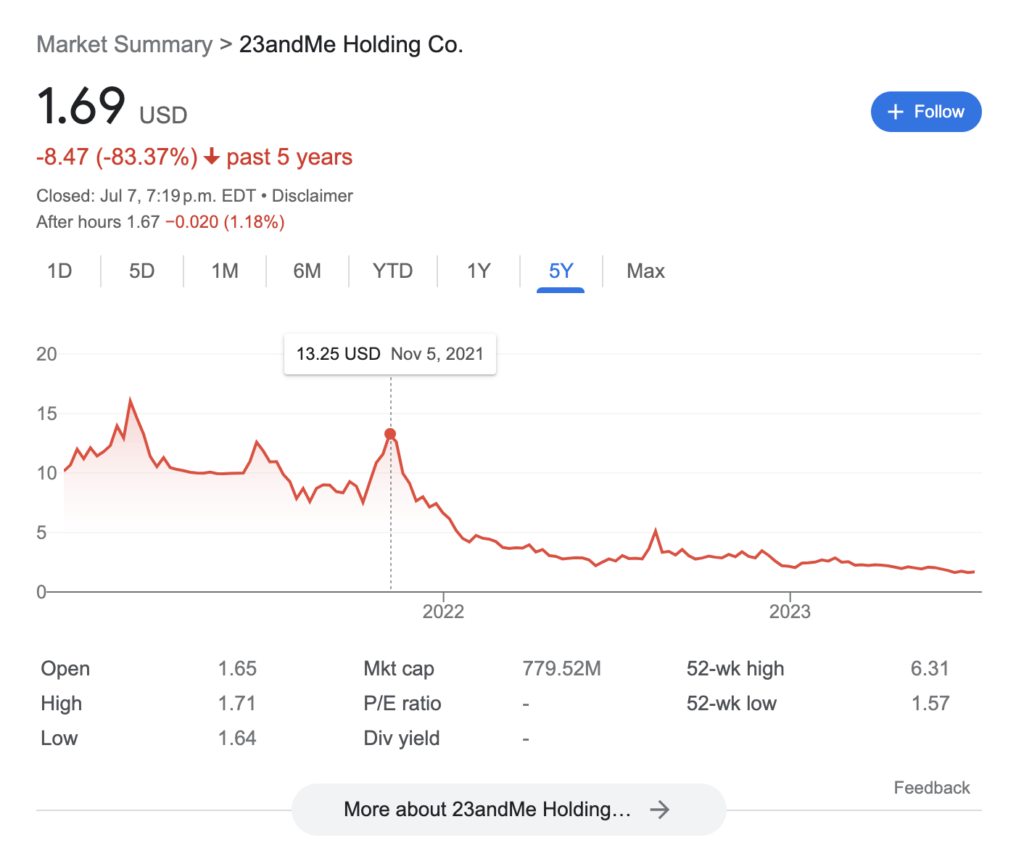

A casual observer of the deal might chalk up the sale as a Cinderella story. The investors made a smashing return and the founders were richly rewarded for their efforts. However, let’s dive deeper into the performance of 23andMe’s stock following the acquisition:

Caught up in a downward current of technology stocks, and slower-than-expected sales, 23andMe’s stock has gone from around $13 to less than $2 in under two years. The 23andMe acquisition of Lemonaid provides a great platform to discuss how you can protect your downside in an acquisition when you’re considering taking shares in your acquirer as a form of payment.

When you sell your business, it’s natural to focus on the headline acquisition valuation, but if you’re going to take stock as part of your consideration, there are some critical deal terms to understand before assessing any offer:

1. How Liquid Is Your Acquirer’s Stock?

If you’re accepting shares as part of an acquisition deal, the first thing to evaluate is the liquidity of your potential acquirer. If the acquirer is a private business, you won’t likely have any liquidity until the majority owner(s) decides to sell unless you are able to negotiate put options (described below).

In most cases, you will need to stick it out until the majority owner(s) wants to sell, which may be decades into the future. If your acquirer is a public company like 23andMe, you’ll need to understand your lock-up period.

Ryan Moran became a minority owner in the business he started and watched helplessly as the new owner ran it into the ground.

2. What’s Your Lock-Up Period?

When you sell to a public company and accept shares as part of your consideration, it’s unlikely you will be able to turn around and sell your shares the day the deal closes. It’s more common to have a lock-up period, which is an amount of time in which you’re required to hold your shares before selling.

In Johnson’s case, his lock-up period was less than 12 months, so he had the right to sell his 23andMe shares before the worst of the stock’s downward spiral.

3. Do You Have “Put” Options?

A put option is the right to sell the shares you accept at a predetermined price (or valuation methodology). This gives you some downside protection such that if the stock in the acquiring company drops below a certain threshold, your losses are minimized because you have the right to put (i.e., sell) your shares onto your acquirer.

Recent guests Tyler Smith and Randy Woods both negotiated put options when they sold.

⛏️ A Tool to Help You Get More Cash Up Front

Don’t want to be paid on stock? Boost your negotiating leverage by creating a business that runs itself. VidGuide showcases your business independence by gathering all your SOPs in one place. That could mean more cash upfront in a deal. Fancy giving VidGuide a try? Begin your free trial today.

📽️ Clip of the Week

In this clip, Johnson describes the lock-up period which restricted him from selling his 23andMe shares.

📣 Quote of the Week

” On the day of closing, although all investors were granted their shares, they weren’t able to sell them until a number of months after that.”

__

– Johnson provides insight into the timeline for when he and his investors could sell their 23andMe shares.

🏆 A Trophy For The Avid Traveller

Not one for material possessions, Johnson decided to travel to one of the most beautiful corners on earth, which he describes at the 01:11:00 mark of the episode.

📈 Recent Deals

- Creaprint SL, a privately-held in-mould label (IML) manufacturer based in Spain, has been acquired by Canadian label and packaging company, CCL Industries. The transaction, which is debt and cash-free, is estimated to be valued at C$38.1 million.

- The well-known Jenny Craig Brand has been acquired by Wellful, Inc., thereby broadening its collection of distinguished health and wellness brands.

- Paperspace, a leading provider of cloud infrastructure as a service for applications leveraging graphics processing units (GPUs), has been acquired by DigitalOcean Holdings, Inc. (NYSE:DOCN), a renowned cloud services provider for small and medium-sized businesses (SMBs) and startups. The transaction was completed for $111 million in cash.

This Week’s Contributors

Colin Morgan, Executive Producer of Built to Sell Radio, John Warrillow, Host of Built to Sell Radio, Daphne Parsekian, Copy Editor, and Denis Labataglia, Audio Engineer.