Running a cleaning business isn’t just about keeping spaces spotless; it’s about navigating a unique landscape of challenges and opportunities that differ significantly from other industries. As a cleaning business owner, you’re not only managing a dedicated team of professionals but also facing the daily reality of competing against undocumented workers offering lower rates. This competition, coupled with the rising costs of cleaning supplies and equipment, presents a complex business environment. Your entrepreneurial journey has led you to build a standout business in a highly competitive market. Whether you’re contemplating an exit due to personal life changes, eager to explore new business avenues, or interested in enhancing the value of your hard-earned enterprise, this article is tailored to help you evaluate and make informed decisions about your next steps in this industry-specific context.

If you wish to understand what your business is currently worth, get a Built to Sell Valuation here.

If you’re interested in understanding the intricacies of market valuation specific to the cleaning industry, keep reading.

Our detailed financial analysis gives you a comprehensive picture, helping you make informed decisions. Let us help you uncover the real value of your HVAC business, considering all the specifics that make your company stand out. Start your journey to realizing the full potential of your hard work. Alternatively, if you’re keen on grasping the nuances of market valuation for an HVAC business, continue reading for an in-depth exploration.

Best for: an insight into the value of similar cleaning businesses

Comparables is a key valuation method that involves comparing your cleaning business to similar companies in the industry that have recently been sold. It’s beneficial to focus on businesses sold in your region to accurately assess the market value. Consider various factors like revenue, customer base, location, and the range of services you offer. How does your cleaning company stack up in comparison? For instance, you can often discover the selling prices of cleaning businesses by networking at industry events or conferences.

Best for: a simple valuation

An asset-based valuation takes your hard assets into account. This could include:

An asset-based valuation takes your hard assets into account. This could include:

Estimate the resale value of your assets, and subtract the total liabilities. Now you’ve got your net asset value.

Struggling with the terminology? Break down the jargon with our M&A Glossary

Best for: Valuing a smaller cleaning business with less than $1 million in annual revenue

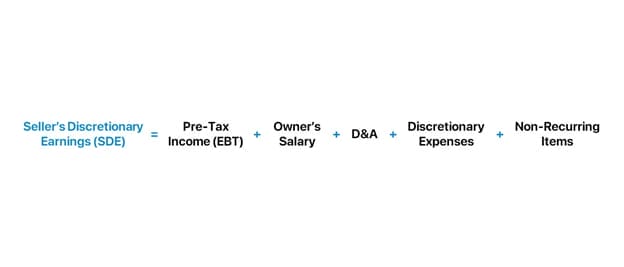

The most common method of valuing a small cleaning business is to use a multiple of your Seller’s Discretionary Earnings (SDE).

This method reflects the total financial advantage your company offers a full-time owner and is, therefore, better for valuing smaller businesses as they’re more likely to be owner operated.

As revenue grows, so does the probability of a business having a management team, so if your company earns over $1 million in annual revenue, a multiple of EBITDA valuation will be more appropriate.

To calculate your HVAC business’s SDE, carry out the following equation:

Add back non-recurring (e.g., legal fees) and discretionary expenditures (e.g., personal phone and fuel) as they don’t reflect mandatory operating costs.

The potential buyer will likely step into an owner-operator role, so you need to reincorporate the salary you’ve allocated to yourself.

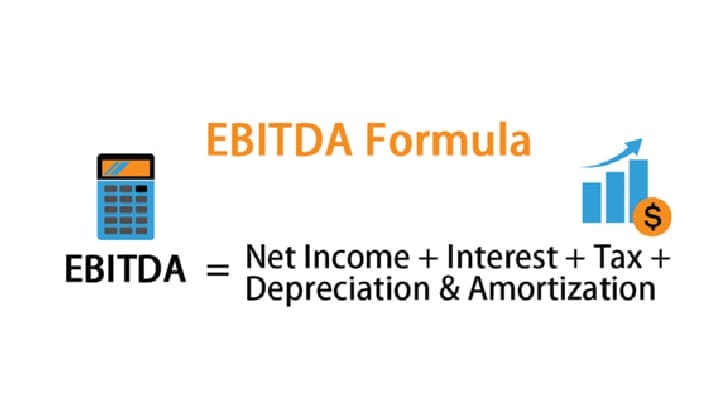

Best for: Larger cleaning businesses that earn over $1 million annually

For larger cleaning companies, it’s better to use a multiple of your Earnings Before Interest Taxes Depreciation & Amortization (EBITDA) to value your business. This is because larger businesses tend to have a management team and are more likely to attract offers from strategic buyers or private equity groups rather than an owner–operator. When calculating your EBITDA, ensure you use a market value salary for your role as the leader of the business.

Use the following formula to calculate your EBITDA:

You’ll see this is very similar to SDE, barring the owner’s compensation.

Take this example. If your annual compensation is $280,000, but a manager with an equivalent skillset could be retained for $200,000 per year, the $80,000 difference is added back (to increase your EBITDA by $80,000).

The less your business relies on you, the more attractive it becomes to buyers. Work toward minimizing your direct involvement in daily operations. Begin by developing comprehensive operation manuals and ensuring your management team can run the business without you.

Demonstrate to potential acquirers that your cleaning business can function without your constant presence by implementing Standard Operating Procedures (SOPs). This standardizes tasks, assigns clear responsibilities, and provides staff training to eliminate failure points, ensuring consistent service quality.

Be transparent with your financial records. Any unreported earnings can negatively impact your business’s valuation. Remember, each unrecorded dollar could reduce the selling price.

A diverse customer base, especially one with a higher proportion of commercial customers, is often perceived as more valuable and less risky. Balancing your portfolio between commercial and residential customers can enhance your company’s appeal. However, it’s crucial to avoid overreliance on a few large customers, regardless of their sector. A broad, well-distributed customer base, particularly with a strong commercial presence, minimizes potential risks and can significantly increase the perceived value of your cleaning business.

The efficiency of your accounts receivable process is key. Long credit terms for customers can affect a buyer’s financing options. Streamlining this process can enhance your business’s appeal.

The size of your business matters. Smaller businesses often encounter financing challenges. Expanding your business before selling can be advantageous.

Establishing recurring revenue via service contracts is a highly effective strategy for your cleaning business, particularly with commercial customers. These contracts provide a predictable and stable financial foundation, enhancing the appeal of your business to potential customers and investors. By focusing on service contracts, which are more prevalent in the commercial sector, you not only ensure a steady income stream but also foster long-term relationships with your customers. This approach simplifies revenue generation, making your cleaning company financially resilient and attractive in a competitive marketplace.

Expanding your customer base by blending residential with commercial contracts is a strategic move to broaden your market reach and stabilize income. This diversification is vital during economic downturns, where the stability of different market segments can vary significantly.

Commercial contracts, typically involving larger spaces and more extensive cleaning needs, can be lucrative. They often include janitorial services, routine maintenance, and specialized cleaning. Establishing contracts with businesses, offices, and other institutions can provide a steady income stream and higher profit margins.

Tailor your marketing efforts to address the specific needs of each segment. Use targeted advertising, community engagement, and digital marketing to reach residential customers. For commercial customers, focus on networking, partnerships, and showcasing your expertise in handling large-scale cleaning projects.

Develop long-term relationships with customers by providing exceptional service, regular follow-ups, and customer loyalty programs. For commercial customers, understanding their cleaning needs and offering customized solutions can foster a strong partnership.

Use technology to enhance customer service and operational efficiency. Implementing management software helps in scheduling, invoicing, and managing customer relationships effectively. This is particularly important in handling a diverse customer base, where different customers have varying needs and expectations.

Built to Sell has assisted thousands of business owners in documenting their crucial Standard Operating Procedures (SOPs) using VidGuide, a versatile tool that seamlessly integrates video instructions within the software your team utilizes to manage your cleaning business.

Effortlessly integrate VidGuide with the cleaning management software you already use, including options like:

This integration allows you to bypass the time-consuming process of creating written manuals, enabling you to quickly produce easily digestible, step-by-step video instructions. Experience the efficiency of VidGuide today with a free trial—no credit card required.

Avoid the painstaking process of creating written instructions by shooting a quick video of your screen to create digestible, step-by-step instructions. Try VidGuide today for free; there’s no credit card required.

Positive customer reviews and a strong reputation within your area will add significant value to your cleaning business. Buyers may research online reviews and customer testimonials to gauge customer satisfaction. If you haven’t yet, make sure to claim your Google My Business profile, and take some time to learn local SEO.

If you’ve got any negative reviews, make sure to carefully reply to them and demonstrate your business’s commitment to your customers.

Enhance the efficiency of converting services into cash for your cleaning business. This involves strategies such as charging part or all of your service fees up front, ensuring rapid collection of receivables, and strategically slowing down outgoing payments. These methods improve your financial health and make your business more attractive to potential acquirers while maintaining good relationships with suppliers. Implementing these practices effectively increases the liquidity and operational efficiency of your business, contributing to its overall appeal in the market.

Investing in modern, efficient equipment can boost operational efficiency and scalability, making your cleaning business more appealing to potential buyers.

The type of buyer you’ll want to sell to depends on your long-term goals post-sale. Are you looking for a clean exit, or would you like to be involved in the business still in some capacity?

Research and identify potential individual buyers, strategic buyers, and private equity firms that may be interested in acquiring your cleaning business. Seek referrals from industry associations, business advisors, and your network.

Individual buyers will be looking to purchase your business as an owner–operator. They may have experience in the cleaning industry and want to own and operate their own business. They might see your cleaning business as an opportunity to be their own boss and potentially expand or improve their existing operations.

Selling to individual buyers is the best option if you have an emotional attachment to your business and want someone dedicated to carrying on its legacy. This may also be in the best interests of your employees.

Larger cleaning companies (such as regional or national cleaning service providers) may want to acquire your business to enhance their market presence or acquire new customers.

Ensure you’ve got Non-Disclosure Agreements (NDAs) in place to protect sensitive information about your business during discussions.

Private equity buyers specialize in acquiring and growing cleaning businesses for their investment portfolios. They’ll typically seek businesses with demonstrated growth potential that they can scale up.

Private equity firms will typically be looking to exit the business in around five years’ time, so expect them to conduct thorough due diligence on your business. You’ll want solid NDAs in place, and they may also request for you to be involved as an advisor post-sale—so be prepared for this to come up in discussions.

You should now have a clearer understanding of the different cleaning business valuation methods, how to reduce risk for buyers, and the types of buyers you may want to target. To get in touch with an advisor, click here.

Mike Agugliaro is an electrician by trade and over 12 years built Gold Medal Service to around $700,000 in revenue with his partner Rob Zadotti.

In 2003, Ron Holt founded Two Maids & a Mop, a residential cleaning business. Thanks to an innovative employee bonus plan, Holt was able to grow his business to 12 company-owned locations.

In 2008, Brandon Lazar started A+ Gutter & Window Cleaning, servicing homeowners in British Columbia, Canada. Lazar successfully bootstrapped the business, generating nearly $1.5 million in revenue before being approached by an acquirer.

Paul Nielsen built HomeTech, a company focused on creating healthier homes by installing skylights for natural lighting and advanced systems for better air quality.