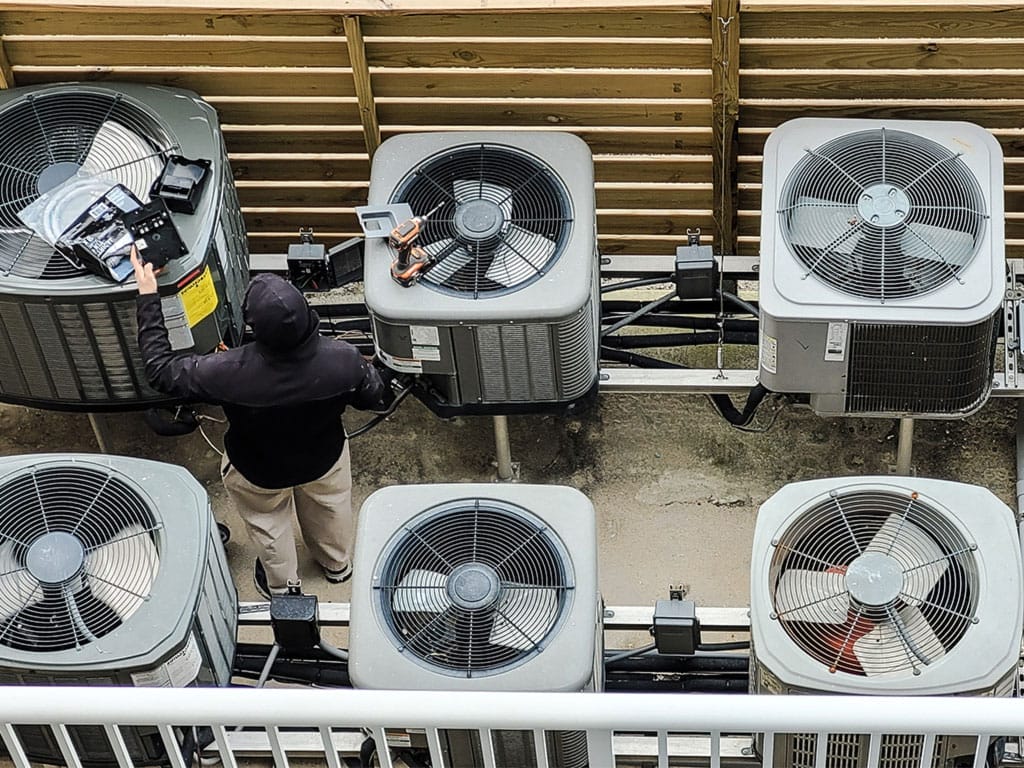

Wondering about the true value of your HVAC business? Whether you’re considering selling, seeking investors, or simply aiming to understand your market position, our specialized valuation service is here for you. Tailored for the HVAC industry, we factor in unique elements like seasonal revenue fluctuations, customer contract structures, and regional market demands.

Our detailed financial analysis gives you a comprehensive picture, helping you make informed decisions. Let us help you uncover the real value of your HVAC business, considering all the specifics that make your company stand out. Start your journey to realizing the full potential of your hard work. Alternatively, if you’re keen on grasping the nuances of market valuation for an HVAC business, continue reading for an in-depth exploration.

Let’s delve into each method so you can decide the right one for your business.

Best for: an insight into the value of similar HVAC businesses

Comparables is a key valuation method that involves comparing your HVAC business to similar companies in the industry that have recently been sold. It’s beneficial to focus on businesses sold in your region to accurately assess the market value. Consider various factors like revenue, customer base, location, and the range of services you offer. How does your company stack up in comparison? For instance, you can often discover the selling prices of HVAC businesses by networking at industry events such as the AHR Expo or the HVAC Excellence Conference

Best for: a simple valuation

An asset-based valuation takes your hard assets into account. This could include:

Estimate the resale value of your assets and subtract the total liabilities. Now, you’ve got your net asset value.

Generally, this method produces the lowest valuation, so for a more realistic figure, we recommend choosing another valuation model.

Struggling with the terminology? Break down the jargon with our M&A Glossary

Best for: valuing a smaller HVAC business with less than $1 million annual revenue

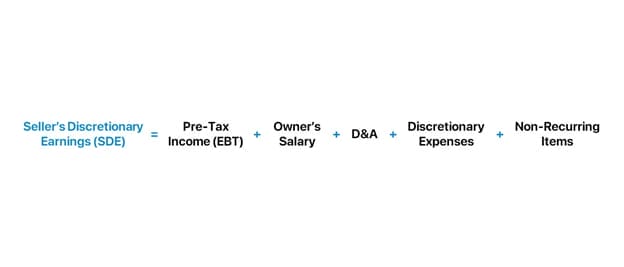

The most common method of valuing a small HVAC business is to use a multiple of your Seller’s Discretionary Earnings (or SDE).

This method reflects the total financial advantage your company offers a full-time owner, and is therefore better for valuing smaller businesses, as they’re more likely to be owner-operated.

As revenue grows, so does the probability of a business having a management team. So if your company earns over $3 million in annual revenue, a multiple of EBITDA valuation will be more useful.

To calculate your HVAC business’s SDE, carry out the following equation:

Add back non-recurring (e.g., legal fees) and discretionary expenditures (e.g., personal phone and fuel) as they don’t reflect mandatory operating costs.

The potential buyer will likely step into an owner-operator role, so you need to reincorporate the salary you’ve allocated to yourself.

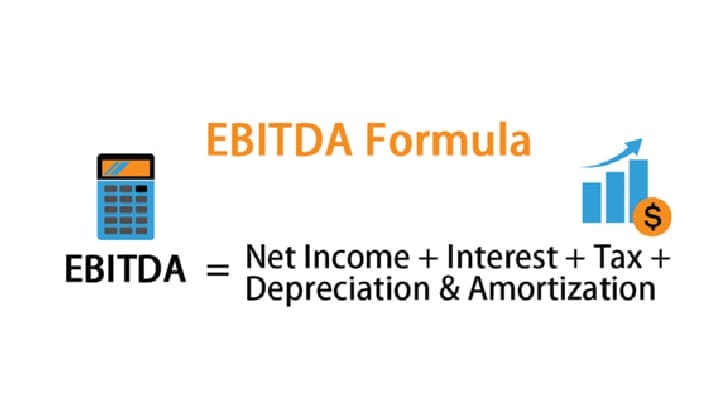

Best for: larger HVAC businesses that earn over $1 million annually

For larger HVAC companies, it’s better to use a multiple of your Earnings Before Interest Taxes Depreciation & Amortization (EBITDA) to value your business.

This is because larger businesses tend to have a management team and are more likely to attract offers from strategic buyers or private equity groups (rather than an owner-operator). So a market-value salary needs to be factored in, which will likely pull in a higher multiple.

This gives you a more accurate scale of minimal and maximum purchase prices.

Use the following formula to calculate your EBITDA:

You’ll see this is very similar to SDE, barring the owner’s compensation.

Take this example. If your annual compensation is $280,000, but a manager with an equivalent skillset could be retained for $200,000 per year, the $80,000 difference is added back (to increase your EBITDA by $80,000).

The less your business relies on you, the more attractive it becomes to buyers. Work towards minimizing your direct involvement in daily operations. Begin by developing comprehensive operation manuals and ensuring your management team can run the business without you.

Demonstrate to potential acquirers that your HVAC business can function without your constant presence by implementing Standard Operating Procedures (SOPs). This standardizes tasks, assigns clear responsibilities, and provides staff training to eliminate failure points, ensuring consistent service quality.

Be transparent with your financial records. Any unreported earnings can negatively impact your business’s valuation. Remember, each unrecorded dollar could reduce the selling price.

Having a diverse customer base minimizes risk perception. Avoid over-reliance on a few large customers, as this can be a deterrent due to potential risk.

The efficiency of your accounts receivable process is key. Long credit terms for customers can affect a buyer’s financing options. Streamlining this process can enhance your business’s appeal.

The size of your business matters. Smaller businesses, particularly those valued under $350,000, often encounter financing challenges. Expanding your business before selling can be advantageous.

Establishing recurring revenue through service contracts is a critical aspect of creating a predictable and appealing business model for your HVAC company. This approach not only adds stability to your financials but also enhances the overall attractiveness of your business to potential customers and investors.

By focusing on creating diverse and tailored recurring revenue streams, your HVAC business can achieve financial stability and growth. This model not only assures consistent revenue but also builds a loyal customer base that values and trusts your services.

Expanding your customer base by blending residential with commercial contracts is a strategic move to broaden your market reach and stabilize income. This diversification is particularly vital during economic downturns, where the stability of different market segments can vary significantly.

Built to Sell has assisted thousands of business owners in documenting their crucial Standard Operating Procedures (SOPs) using VidGuide, a versatile tool that seamlessly integrates video instructions within the software your team utilizes to manage your HVAC business.

Effortlessly integrate VidGuide with the HVAC management software you already use, including options like:

This integration allows you to bypass the time-consuming process of creating written manuals, enabling you to quickly produce easily digestible, step-by-step video instructions. Experience the efficiency of VidGuide today with a free trial – no credit card required.

Avoid the painstaking process of creating written instructions by shooting a quick video of your screen to create digestible step-by-step instructions. Try VidGuide today for free; there’s no credit card required.

Positive customer reviews and a strong reputation within your area will add significant value to your business. Buyers may research online reviews and customer testimonials to gauge customer satisfaction. If you haven’t yet, make sure to claim your Google My Business profile and take some time to learn Local SEO.

If you’ve got any negative reviews, make sure to carefully reply to them and demonstrate your business’s commitment to your customers.

Enhance the efficiency of converting services into cash for your HVAC business. This involves strategies such as charging part or all of your service fees upfront, ensuring rapid collection of receivables, and strategically slowing down outgoing payments. These methods improve your financial health and make your business more attractive to potential acquirers, while maintaining good relationships with suppliers. Implementing these practices effectively increases the liquidity and operational efficiency of your business, contributing to its overall appeal in the market.

Investing in modern, efficient equipment can boost operational efficiency and scalability, making your business more appealing to potential buyers.

The type of buyer you’ll want to sell to depends on your long-term goals post-sale. Are you looking for a clean exit, or would you like to be involved in the business still in some capacity?

Research and identify potential individual buyers, strategic buyers, and private equity firms who may be interested in acquiring your HVAC business. Seek referrals from industry associations, business advisors and your network.

Individual buyers will be looking to purchase your business as an owner-operator. They may have experience in the HVAC industry and want to own and operate their own business. They might see your HVAC business as an opportunity to be their own boss and potentially expand or improve existing operations.

Selling to individual buyers is the best option if you have an emotional attachment to your business and want someone dedicated to carrying on its legacy. This may also be in the best interest of your employees.

Larger HVAC companies (such as regional or national HVAC service providers) may want to acquire your business to enhance their market presence or acquire new customers.

Ensure you’ve got Non-Disclosure Agreements (NDAs) in place to protect sensitive information about your business during discussions.

Private equity buyers specialize in acquiring and growing HVAC businesses for their investment portfolios. They’ll typically seek businesses with demonstrated growth potential that they can scale up.

Private equity firms will typically be looking to exit the business in around 5 years time, so expect them to conduct thorough due diligence on your business. You’ll want solid NDAs in place, and they may also request for you to be involved as an advisor post-sale – so be prepared for this to come up in discussions.

You should now have a clearer understanding of the different HVAC valuation methods, how to reduce risk for buyers and the types of buyers you may want to target. For more valuable resources, take a look at our best-selling books, interactive courses, informative blog posts and our business podcast. We’ll help you become a better business owner, punch above your weight in negotiations and maximize your exit to achieve your long-term goals.

Mike Agugliaro is an electrician by trade and over 12 years built Gold Medal Service to around $700,000 in revenue with his partner Rob Zadotti.

In 2003, Ron Holt founded Two Maids & a Mop, a residential cleaning business. Thanks to an innovative employee bonus plan, Holt was able to grow his business to 12 company-owned locations.

In 2008, Brandon Lazar started A+ Gutter & Window Cleaning, servicing homeowners in British Columbia, Canada. Lazar successfully bootstrapped the business, generating nearly $1.5 million in revenue before being approached by an acquirer.

Paul Nielsen built HomeTech, a company focused on creating healthier homes by installing skylights for natural lighting and advanced systems for better air quality.