Today in Built to Sell News, we’re covering the psychology behind selling your business, including how to:

- Temper the highs and lows of selling a business

- Understand the brain chemistry of exit

- Lean on outsiders for objective feedback

- Get clear on your “pull factors”

- Find your next adventure

- Avoid second guessing yourself

- Find a tribe of friends who understand

- Separate your identity from your work

This week on Built to Sell Radio, we sat down with clinical psychologist, speaker, and author Dr. Sherry Walling (Listen Now).

Dr. Walling, who also happens to be married to former Built to Sell Radio guest Rob Walling, is renowned for her work helping entrepreneurs navigate the mental and emotional hurdles of building and exiting a company. The conversation provides a blueprint for avoiding the regret that some founders experience after selling:

- Temper the Highs and Lows

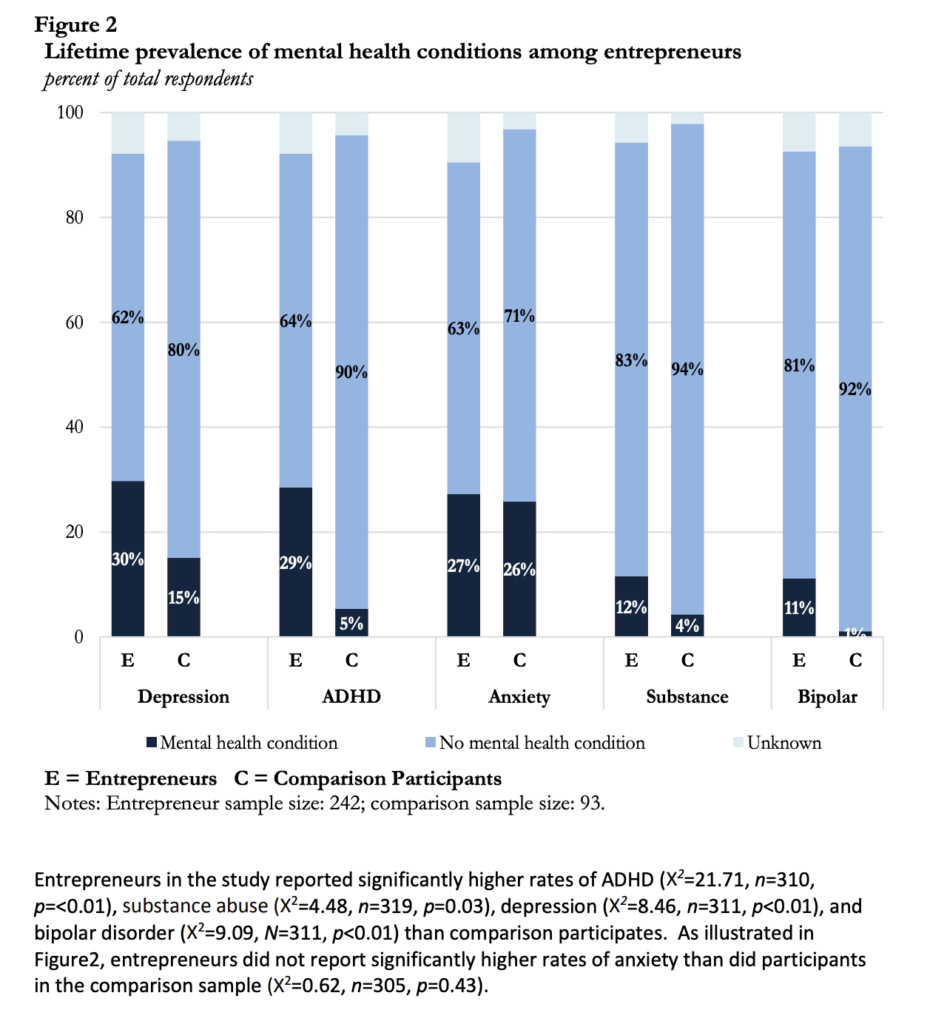

Dr. Walling pointed to a study by Dr. Michael Freeman, whose research shows that founders are statistically more likely to suffer from ADHD and bipolar disorder. The same study reveals that 72% of founders express concern about their mental health. When you combine the brain chemistry of these conditions with the natural highs and lows of selling a business, you have a recipe for potential problems.

Just knowing that you might be more predisposed to feeling pronounced highs and lows can go a long way in blunting the worst of it.

- The Brain Chemistry of Exiting

The same study cited by Dr. Walling found that the brain activity of entrepreneurs describing their businesses is similar to the brain activity of parents describing their children. The same areas of the brain light up, suggesting that entrepreneurs may have a deep emotional attachment to their businesses, similar to the attachment that parents feel towards their children.

Just like when a child leaves for college, you will feel a sense of sadness when you sell your business. However, try to celebrate when your company thrives after you’re gone as you would your adult child achieving something important. Take satisfaction in having given birth to something great.

- Lean on Outsiders

Mothers don’t like being told their child is the ugliest in the maternity ward. Similarly, no founder likes to be told their business has flaws. Dr. Walling refers to this as “suppression of criticism,” and it’s a common phenomenon for both parents and founders.

This tendency can lead founders to have an inflated sense of what their business is worth and disregard its flaws. Dr. Walling warns that it’s virtually impossible to be objective about your own business, which is why she recommends leaning heavily on an outside advisor.

Get someone you trust to tell it to you straight.

- Get Clear on Your “Pull Factors”

Most founders experience emotions that make them want to sell their business. These “push factors” can include problems with employees, competitors, regulation, taxes, etc. However, it is also important to get clear on your “pull factors.” These are the things that are pulling you towards your next adventure.

Journal about what you are excited to do next. Do you want to write a book? Start a new business? Travel? Whatever it is, take some time to think about what you want to experience and achieve in the next chapter of your life.

We have a free tool called PREScore™ which can help you think through your pull factors.

- Don’t Jump Out of The Frying Pan Into The Fire

Dr. Walling recommends that you take six months after you sell your business to develop a learning syllabus. Think about something you want to learn that has nothing to do with business. Maybe you’ve always dreamt of learning to play guitar, tending to a vegetable garden, or learning a new language.

Whatever it is, give yourself six months to read and learn before committing to your next big adventure.

- Don’t Be a Monday Morning Quarterback

No matter how well you negotiate the sale of your business, you may start to second-guess yourself. You may wonder if you left money on the table or could have squeezed the other side for one more concession. It is natural to replay a big deal in your head, but don’t obsess over it. You did the deal with the information you had at the time, and you are likely wealthier than the top 1% of people on the planet.

Every time you start rehashing the sale in your mind, make a list of ten things you are grateful for. The feelings of regret will quickly dissipate.

- Find a Tribe

Dr. Walling pointed out that it is important to find a new tribe of friends who can identify with what you are going through. Selling a business is a relatively rare occurrence, so it is unlikely that your friends and family will be able to relate. While she suggests that you keep close to your existing circle of contacts, she also recommends proactively seeking out a handful of new friends who have experienced a business exit.

- Separate Identity from Activity

Many founders conflate what they do with who they are. They might introduce themselves as “an entrepreneur,” even though that is just one thing they do. A healthier approach is to separate your identity from your work. For example, you can say “I own a business” instead of “I’m a business owner.” This distinction can make it easier to sell your business if you ever decide to do so.

📽️ Clip of the Week

In this clip, Dr. Walling describes the single biggest predictor of a founder experiencing regret post-sale.

📣 Quote of the Week

“I do a thing. I am a thing. And the distinction there is important.”

– Dr. Walling elaborating on the importance of separating your identity from the work you do.

⚒️ Tools For Founders Considering an Exit

- If you’re preparing for an exit, you’ll need to prove to an acquirer that your business can run without your direct involvement. VidGuide™ allows you to curate a comprehensive video playbook for your business which you can merchandise for an acquirer as proof they’ll be able to run your business without you. Set up a free VidGuide trial.

- If you’re curious, get your Personal Readiness to Exit — or PREScore™ here. It’s free and can help you avoid regret.

📈 Recent Deals

- ARAG Group and its subsidiaries are set to be acquired by Nordson Corporation (Nasdaq: NDSN), as per a definitive agreement announced this week. Valued at an enterprise value of €960 million, the all-cash transaction with Nordson indicates a valuation of approximately 16.5 times ARAG’s projected 2023 EBITDA. ARAG is projected to generate sales of €155 million in FY2023.

- RedBird Capital, the owner of AC Milan, has teamed up with actor Ryan Reynolds’ Maximum Effort Investments and sports investor Otro Capital to acquire a 24% stake in the Renault-backed Alpine Formula 1 racing team. The investment, valued at €200 million, values the team at £900 million.

Know a founder who recently navigated a business sale and has an inspiring story to tell? If so, we’d love for you to nominate them.

This Week’s Contributors

Colin Morgan, Executive Producer of Built to Sell Radio, John Warrillow, Host of Built to Sell Radio, Daphne Parsekian, Copy Editor, and Denis Labataglia, Audio Engineer.